Prediction Markets: Overview

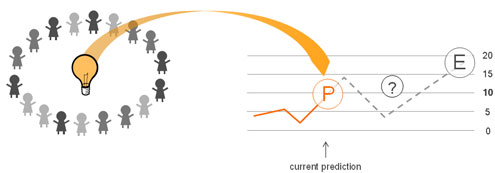

Prediction markets (also: information markets) take advantage of the phenomenon of collective intelligence. Thereby the aggregated knowledge of many individuals is given higher relevance than the knowledge of single experts.

Prediction markets are based on the concept of stock-markets. Each event that should be predicted is represented by a share. These prediction-shares are being traded similar to stock-market shares. The current share-price (P) equals the aggregated expectation of all participants - the prediction for the future outcome of the given event (E):

Based on a thesis of the economist and Nobel Prize winner Friedrich August von Hayek prices are indicators for distributed information. In words of a stock-broker prediction-shares are futures for certain upcoming events.

The value of prediction-markets:

Prediction-markets have a wide range of application:

Contact us: office@prokons.com

Prediction markets are based on the concept of stock-markets. Each event that should be predicted is represented by a share. These prediction-shares are being traded similar to stock-market shares. The current share-price (P) equals the aggregated expectation of all participants - the prediction for the future outcome of the given event (E):

Based on a thesis of the economist and Nobel Prize winner Friedrich August von Hayek prices are indicators for distributed information. In words of a stock-broker prediction-shares are futures for certain upcoming events.

The value of prediction-markets:

- encourage its participants to think about relevant future topics

- aggregate distributed knowledge of its participants (information-carriers)

- deliver valid real-time predictions

Prediction-markets have a wide range of application:

- Corporate information-markets

- political-markets

- public-markets on various topics (economics, sports, boulevard or events)

- edutainment-markets: stock-market simulations for education and research purposes

Contact us: office@prokons.com